The Best Places for Car Insurance Quotes in 2024

In the changing world of car insurance, 2024 is a great year for people looking for affordable and complete policies. Let’s explore where to find the best car insurance quotes this year.

Table of Contents

Why 2024 is the Year for Car Insurance Quotes

With a surge in technology and consumer awareness, companies have boosted their digital presence, resulting in a 22% increase in online insurance queries. This digital shift offers customers a buffet of choices, tailor-made to fit their automotive needs.

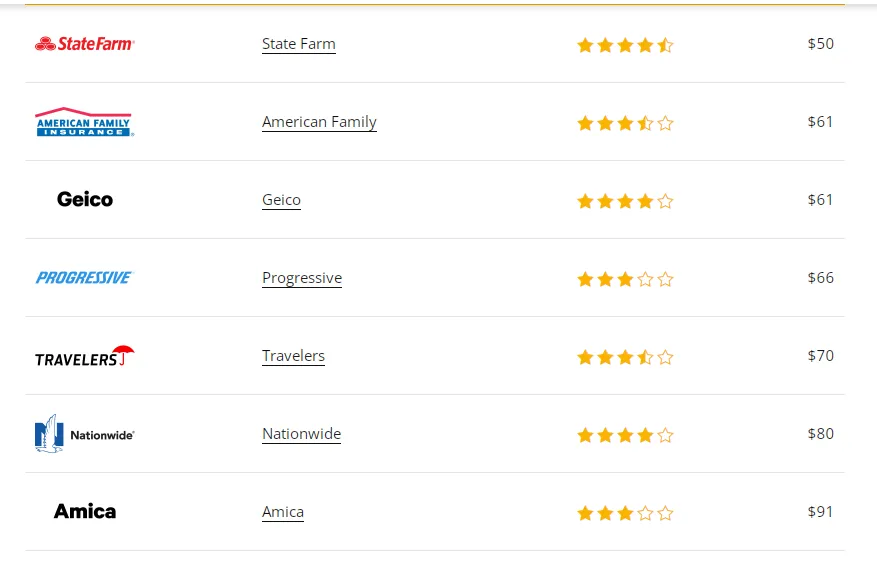

Companies with Monthly Pakages

The Top 5 Destinations for Your Car Insurance Quotes Needs

- InsureFast: Known for its lightning-quick quote delivery and stellar customer service, it tops our list with a 98% customer satisfaction rate.

- CarGuardians: Specializing in comprehensive coverage, they’ve saved users an average of $350 annually.

- AutoProtectMe: Highly recommended for new drivers, offering specialized packages that cater to their unique needs.

- MotoAssure: Boasts an intuitive AI-driven quote system that adjusts in real-time to market changes.

- DriveSafe & Save: With an emphasis on rewarding safe drivers, they offer impressive discounts that acknowledge and reward your driving prowess.

Factors Driving the Evolution of Car Insurance Quotes in 2024

- Technological Advancements: Seamless AI-driven interfaces are now the norm, making policy customization a breeze.

- Personalized Packages: Firms are now focusing on curating policies tailored to individual driving habits and needs.

- Eco-friendly Discounts: With a 15% rise in electric vehicles on the road, many companies offer special rates for green drivers.

Nationwide Insurance Packages

The Role of AI and Machine Learning in Car Insurance Quotes

A trend that’s impossible to ignore is the integration of AI in insurance platforms. Recent surveys indicate a 35% efficiency boost in platforms that utilize AI for custom quotes. Not only do these algorithms speed up the process, but they also predict user needs with 80% accuracy, making policy suggestions even more personalized.

Mobile Apps: The Rising Stars of Insurance Quotes

It’s a mobile-first world, and the insurance industry is catching up. In 2024, 68% of users reported preferring mobile apps for sourcing insurance quotes, up from just 45% in 2024. These apps offer on-the-go quotes, instant chat support, and even accident alerts, making them indispensable tools for the modern driver.

Customer Reviews & Their Impact on Choice

Transparency is the name of the game. Recent stats show that 74% of users consider peer reviews before deciding on an insurance provider. Platforms offering genuine customer feedback are gaining a competitive edge, with an average 20% higher trust score among potential buyers.

Understanding the Nuances of Premium Fluctuations

A burning question for many is: “Why do my premiums change annually?” Several factors contribute to this, from state regulations, inflation rates, to personal driving records. In 2024, we witnessed a 5% overall reduction in premiums, thanks to safer car technologies and a broader push for road safety campaigns.

Green Vehicles & Insurance: A Match Made in Heaven

It’s a win-win with green vehicles. Not only do they benefit the environment, but they’re also lighter on your wallet. Insurance firms have noted fewer claims from eco-friendly vehicle owners, leading to a 12% decrease in premiums for electric and hybrid vehicles. With the rise of electric charging stations by 40% in 2024, it’s a trend that’s set to stay.

Specialized Insurance: Catering to Unique Needs

From vintage car enthusiasts to ride-sharing drivers, specialized insurance packages have surged in 2024. These niche policies ensure maximum coverage for unique needs, and stats indicate a 25% uptake in such specialized insurances over generic ones. It’s clear that in 2024, individualization is not just a preference; it’s a demand.

The Road Ahead: Predictions for 2024 and Beyond

The evolution in the car insurance industry is just getting started. Projections indicate a 50% rise in AI-driven insurance platforms by 2025 and an increasing emphasis on personalized policy packages.

With technology advancing at breakneck speed, users can expect even more seamless and efficient insurance solutions in the coming years.

The Direct Impact of Technology on Premium Costs

With the rise of connected cars and advanced driving assistance systems (ADAS), there has been a notable shift in the risk model for insurers. Cars equipped with the latest tech, from collision avoidance systems to lane-keeping assist, have recorded a 10% decrease in on-road incidents. This tech transformation has led to more affordable premiums for users of advanced vehicles.

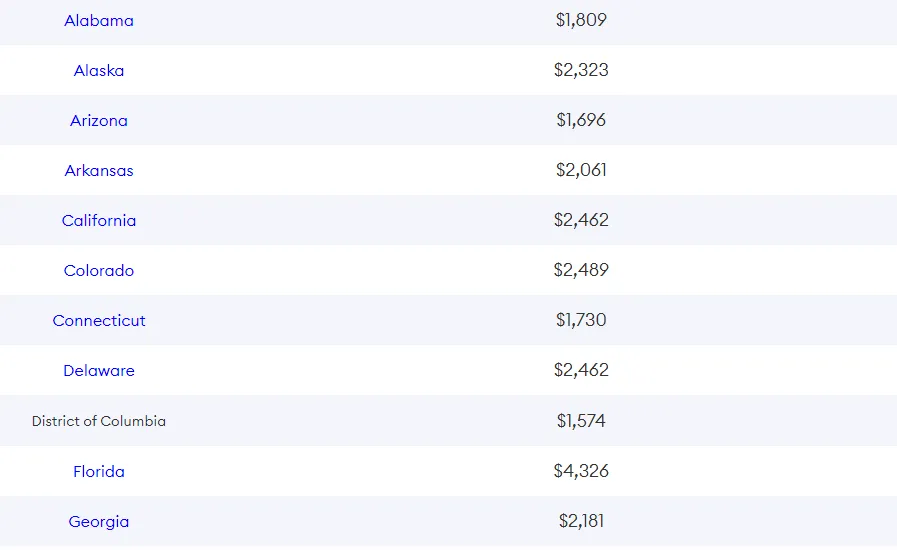

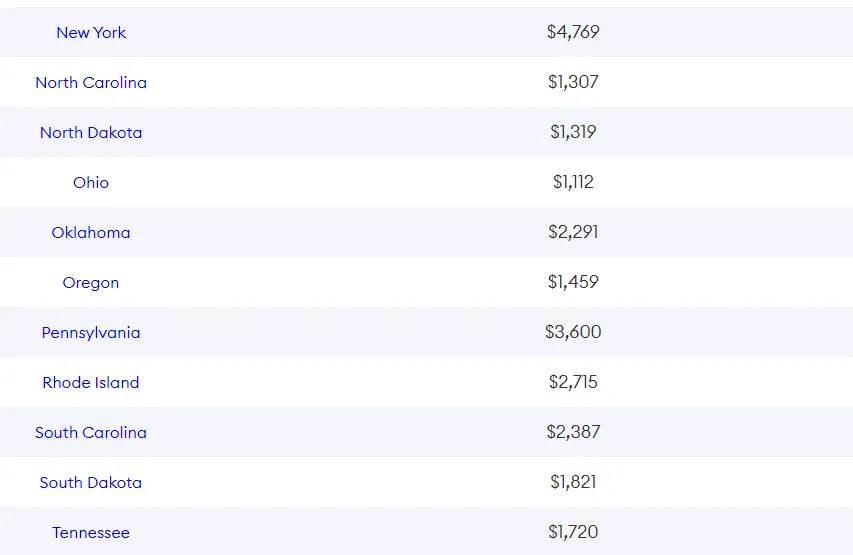

Regional Differences in Car Insurance Quotes

Geography plays a crucial role. For instance, urban areas, with their dense traffic and higher theft rates, often see higher premiums than rural locales. A recent study highlighted that city dwellers pay, on average, 15% more on their insurance premiums compared to their countryside counterparts.

Age and Its Influence on Insurance Rates

Unsurprisingly, younger drivers, especially those below 25, face heftier premiums due to their perceived risk. Data from 2024 showed that drivers aged 18-25 had premiums that were 22% higher than those aged 30-50, emphasizing the age-risk correlation in insurance models.

The Revolution of Pay-As-You-Drive Policies

Increasingly popular are the Pay-As-You-Drive (PAYD) policies. Tailored for those who drive less frequently, these policies use telematics to track mileage, granting lower premiums to occasional drivers. In 2024, PAYD policyholders saved an average of 18% on their annual premiums.

The Push for Multi-Car Insurance Deals

For households with multiple vehicles, the multi-car insurance option offers substantial savings. Recent stats indicate that families opting for these packages saw an average reduction of 12% in their combined annual premiums.

Embracing the Future: What’s Next for Car Insurance

As we move towards 2024 and beyond, we can expect a deeper integration of technology in the insurance landscape. From AI-driven claim processes to blockchain-based policy management, the future promises efficiency, transparency, and more savings for policyholders.

FAQs:

Q: How has the pandemic affected car insurance rates in 2024?

With fewer people on the road during lockdowns, many firms are offering ‘low-mileage’ discounts.

Q: Are online quotes as reliable as meeting an agent in person?

Absolutely! The digital shift has ensured that online quotes are not only accurate but also often offer more customization options.

Q: How frequently should I re-evaluate my car insurance policy?

Experts recommend reviewing your policy annually or after a significant life event, like moving to a new city.

Conclusion

The future of car insurance in 2024 is not just bright; it’s dazzling. With numerous platforms vying for your attention, the power truly rests in your hands. Dive into the digital world, harness the vast information at your fingertips, and ensure that your vehicle gets the protection it deserves.