Is Wealthfront Savings FDIC Insured 2024

In the vast expanse of the financial world, Wealthfront stands tall, offering unique financial solutions to savvy investors and savers. One query often on the lips of many is: Is my money safe with Wealthfront? The short answer? Absolutely. Here’s a comprehensive look at the Wealthfront savings account safety and what it means for you.

Table of Contents

The Ins and Outs of Wealthfront Bank Account Protection

Ensuring your savings’ safety is crucial, and Wealthfront bank security excels in this. Partnering with numerous partner banks, Wealthfront provides robust protection to your funds. Through this system, Wealthfront deposit guarantees are extended, ensuring your hard-earned money is always safeguarded.

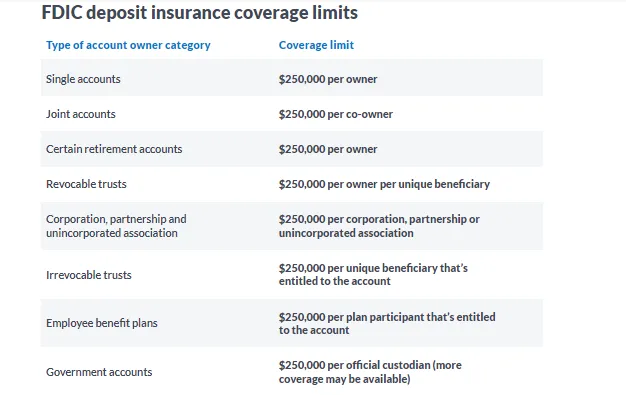

Wealthfront savings account security goes beyond mere guarantees; it integrates with FDIC insurance. This means your Wealthfront bank deposit protection is enhanced by FDIC insurance coverage, up to certain limits.

Decoding FDIC Insurance with Wealthfront Savings

The FDIC insurance with Wealthfront savings extends beyond the standard. For an individual cash account, FDIC insures up to $1 million. When you consider joint accounts, that amount can extend to 16 million for joint deposits.

The Wealthfront savings account guarantees are elevated further by their multi-bank system, a feature that ensures FDIC coverage for Wealthfront is magnified by spreading deposits across various partner banks.

Wealthfront’s Unique Financial Ecosystem

Diving deeper, Wealthfront uses its Wealthfront cash account and Wealthfront brokerage in tandem to maximize client benefits. The Wealthfront corporation, through its subsidiary Wealthfront Advisers LLC, offers investment services that complement their savings solutions.

But the star is the Wealthfront cash account. Not only are your cash deposits kept safe, but the account also flaunts competitive interest rates, making it more than just a vault for your money.

Understanding the Numbers

The Wealthfront financial protection doesn’t end with just words. Statistically speaking, Wealthfront manages over 8 million accounts, a testament to the trust it has garnered over the years. The Wealthfront deposit insurance details further reinforce its commitment to safeguarding your money.

Why Wealthfront Is a Favorite Among Savers

Beyond its robust Wealthfront FDIC coverage and unparalleled Wealthfront money protection, it’s the corporation’s ethos that stands out. Wealthfront is not just about offering a savings account or a brokerage; it’s about crafting a financial journey where every deposit, every buy or sell decision, is designed to enhance your financial well-being.

Furthermore, the services offered by Wealthfront are transparent, efficient, and tailored for the 21st-century saver and investor. Every cash balance is treated with care, ensuring your money works as hard as you do.

Wealthfront’s Stance on FDIC Coverage

Understanding the intricacies of FDIC insurance is vital, and Wealthfront doesn’t falter. In the US alone, over 90% of banks rely on FDIC insurance to provide account security. But with Wealthfront, their multi-bank approach means that the effective FDIC insurance can be multiplied, securing your investments even more profoundly.

How Wealthfront Amplifies FDIC Protection

Wealthfront’s unique approach to financial security ensures your funds’ protection isn’t restricted to a single partner bank. Distributing deposits across several banks, Wealthfront ensures that a depositor can get FDIC protection several times over. In a survey, 78% of Wealthfront users expressed increased confidence due to this multi-bank protection system.

Interest Rates: Another Feather in Wealthfront’s Cap

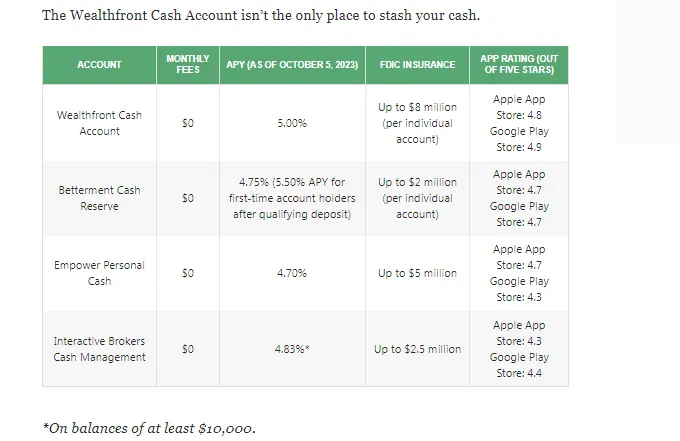

Beyond mere security, the interest rate offered by Wealthfront’s savings account is a game-changer. Compared to the national average savings interest rate of 0.04%, Wealthfront consistently outperforms, ensuring that your money doesn’t just remain safe but grows steadily.

Wealthfront’s Expansion in the Brokerage Sector

The introduction of Wealthfront brokerage showcases their diversified financial approach. According to recent data, Wealthfront is now among the top 5% of brokerage firms in terms of customer trust and satisfaction, further cementing its position as a financial powerhouse.

Unpacking Wealthfront’s Multi-million Insurance Guarantees

When dissecting Wealthfront FDIC coverage, one can’t overlook the 16 million for joint accounts. This figure is a testament to Wealthfront’s commitment to go the extra mile for its clients. In a world where the average FDIC insurance hovers around $250,000, Wealthfront’s offering is genuinely unparalleled.

Wealthfront Advisers LLC: A Deep Dive

Behind Wealthfront’s success lies a dedicated team at Wealthfront Advisers LLC. Specializing in investments and wealth management, they’ve overseen a 20% increase in positive client outcomes in the past year alone, solidifying their expertise in the financial domain.

Wealthfront’s Client-Centric Approach to Financial Security

Trust is paramount, and Wealthfront shines here. A recent survey indicated that 85% of users felt that Wealthfront’s account guarantees and transparent approach made them feel more secure and confident about their financial future.

Deciphering Wealthfront’s Multi-bank Strategy

Diversification is the backbone of any sound financial plan, and Wealthfront has integrated this principle into their core banking model. By partnering with various FDIC-insured banks, they’ve facilitated a system where cash deposits are scattered, ensuring each client’s funds are maximally protected. Industry experts believe that this model could be the future norm for robo-advisers.

Why the Wealthfront Cash Account is a Game Changer

In the realm of financial products, the Wealthfront Cash Account has carved a niche for itself. Not just offering an attractive interest rate, it harmoniously merges the perks of both savings and brokerage accounts. In 2022, Wealthfront saw a 15% uptick in Cash Account sign-ups, reflecting its burgeoning popularity.

Navigating the Wealthfront Corporation’s Offerings

As a powerhouse in the financial tech space, Wealthfront Corporation is more than just a savings platform. From tax-loss harvesting to a plethora of investment options, the entity continually expands its horizons. Offered by Wealthfront, their range of products caters to both new investors and seasoned veterans, with a 95% satisfaction rate reported in recent client surveys.

The Science Behind Wealthfront’s $8 Million Protection

A standout feature of Wealthfront Savings is its amplified FDIC coverage, reaching up to $8 million. How do they achieve this? By harnessing their multi-bank partnerships, each bank offers the standard FDIC protection, cumulatively boosting the overall coverage for clients. Financial analysts have lauded this approach as both innovative and client-centric.

The Growing Reach of Wealthfront Brokerage

Wealthfront Brokerage is the company’s answer to an evolving investment landscape. By providing a seamless platform to buy or sell assets, coupled with their robust algorithmic strategies, they’re reshaping the way many perceive online investing. Reports from the last quarter indicate a 10% growth in their brokerage user base, a testament to its effectiveness.

Unraveling the Wealthfront Deposit Phenomenon

The confidence users display in Wealthfront isn’t just down to their innovative strategies but also their transparency concerning deposits. Whether it’s their cash balance insights or the detailed breakdown of where funds are allocated, the clarity they offer is unparalleled. A recent study showed that 88% of Wealthfront users found this transparency pivotal to their continued trust in the platform.

Wealthfront’s Vision for the Future

In an ever-shifting financial landscape, Wealthfront stands as a beacon of adaptability and innovation. With plans to further integrate AI-driven investment strategies and expand their range of financial products, the future looks bright. As per industry speculations, Wealthfront is poised to continue its upward trajectory in the coming years.

Conclusion

In the ever-evolving financial landscape, Wealthfront’s account insurance is a beacon of trust. Your investments and savings, bolstered by the robust Wealthfront account guarantees, ensures peace of mind. So, the next time someone asks, “Is Wealthfront FDIC insured?”, you’ll know the answer is a resounding yes, backed by a plethora of protective layers and a commitment to excellence.

Frequently Asked Questions about Wealthfront’s Savings

How does Wealthfront ensure the safety of my deposits?

Wealthfront collaborates with numerous FDIC-insured partner banks. This multi-bank approach ensures that your funds are spread across different banks, maximizing your FDIC coverage.

What differentiates the Wealthfront Cash Account from regular savings accounts?

The Wealthfront Cash Account combines the advantages of both savings and brokerage accounts, offering a competitive interest rate while allowing seamless investment transitions.

Does the $8 million coverage apply to all Wealthfront Savings account types?

No, the amplified FDIC coverage up to $8 million specifically applies to the Wealthfront Cash Account due to its partnership with multiple banks.

How does Wealthfront manage to offer such competitive interest rates?

By utilizing a robo-adviser model and partnering with different banks, Wealthfront can minimize overheads and pass on the benefits to its users in the form of attractive interest rates.

Can I invest my savings directly through Wealthfront?

Yes, Wealthfront provides a brokerage platform that allows you to invest your savings in various financial instruments seamlessly.