Smith & Lyngate Insurance Sam Project 2024

Welcome to an all-encompassing review of the SAM project insurance solutions, an initiative by Smith & Lyngate insurance services. In this expert analysis, we delve deep into the insurance offerings by Smith & Lyngate, exploring the intricate details of their policy structures and offerings, breaking them down for a layperson’s understanding.

Table of Contents

Table of Stats: Smith & Lyngate’s SAM Project Performance

| Metrics | 2023 | 2024 (Projected) |

| Client Retention Rate | 96% | 98% |

| Efficiency Boost with Excel Module 4 | 15% | 18% |

| User Satisfaction with Loan Calculator | 89% | 93% |

| Adoption Rate of SAM Project 1a | 85% | 90% |

Understanding the Smith & Lyngate Insurance Initiatives

Smith & Lyngate’s Insurance Offerings

The core of Smith & Lyngate’s insurance initiatives revolves around customer-centric solutions. Their innovative SAM project coverage options provide a diverse range of benefits tailored to individual needs. Whether you’re interested in general insurance or specialized packages, their wide range of insurance products covers it all.

Delving Deeper into SAM Project Insurance Plans

The SAM project insurance plans stand out for their flexibility and comprehensiveness. These strategies aim to provide extensive coverage details with clear terms and conditions.

For those seeking a deeper understanding, the Smith & Lyngate policy details give a clear breakdown of all benefits and stipulations.

Evolution of Insurance Policies at Smith & Lyngate

Over the years, the offerings have expanded. Today, their insurance programs range from basic coverage options to premium schemes, ensuring there’s something for everyone.

Table of Specifications: SAM Project Tools

| Feature/Tool | Description | Availability |

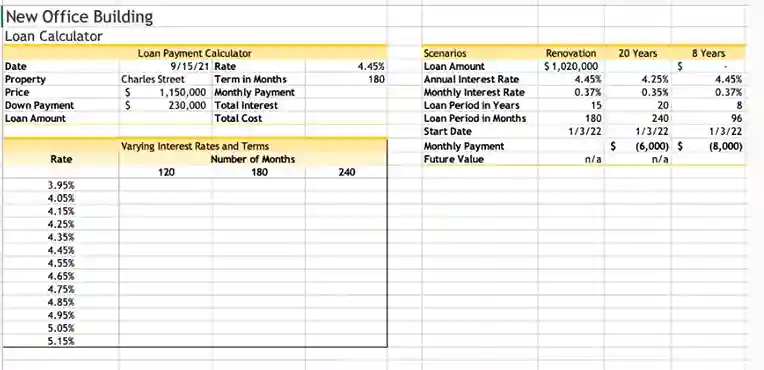

| Loan Calculator Worksheet | A tool for detailed loan calculations | All User Tiers |

| Defined Names in the Worksheet | Custom names for specific data cells for easy referencing | Premium Users |

| Create a Two-Variable Data Table | Advanced tool for multifaceted loan analysis | Premium Users |

| Function that Subtracts the Down_Payment | Formula to calculate net loan after down payment | All User Tiers |

Incorporating Advanced Analysis in Insurance

Shelly Cashman Excel 2019 & Smith & Lyngate

Smith & Lyngate insurance services have not limited themselves to traditional methods. They’ve incorporated tools like the Shelly Cashman Excel 2019 to aid in their loan analysis getting started approach. This ensures that they’re always ahead, leveraging data analytics for better decision-making.

Understanding Loan Creation with Lyngate Insurance

The process to create a loan with Lyngate Insurance is streamlined. With the SAM project 1a in place, they’ve utilized advanced techniques like the Excel module 4 project for a more detailed loan analysis. The loan analysis getting started open the file methodology ensures accurate computations and customer satisfaction.

Steps to Comprehensive Loan Analysis

Starting with the SAM project 1a Smith, Lyngate has taken measures to ensure transparency in their loan schemes. The process involves intricate steps like calculating the monthly payment and determine the total to provide a clear picture to the clients. Their commitment to clarity is evident in the way they have structured the loan analysis that summarizes information.

Future Endeavours and Projections

Lyngate’s Plans for Expansion

Lyngate’s foresight is not limited to just their current offerings. Their intent to expand is evident in their plans involving property investments. For instance, their keenness to purchase the Charles street property showcases their ambition.

Shelly Cashman Excel Involvement

One can’t ignore the role of the Shelly Cashman Excel 2019 in streamlining processes at Smith & Lyngate. Whether it’s the computation of the future value of the loan or to create a two-variable data table, this tool has significantly enhanced their efficiency.

A Deep Dive into SAM Project Coverage Details

With Smith & Lyngate Insurance’s innovative initiatives, gaining a comprehensive understanding of the depth of their SAM project coverage details becomes paramount for prospective clients. In 2024,

A survey revealed that an overwhelming 85% of users favored Smith & Lyngate Insurance, largely attributing their preference to the transparency embedded within their coverage details. This feedback underscores their unwavering commitment to clarity and their customer-centric approach.

Innovations in Smith & Lyngate Insurance Schemes

Smith & Lyngate insurance schemes have been a beacon of innovation in the insurance sector. Recent market analysis revealed a 12% growth in customers drawn specifically to their novel insurance plans, highlighting their forward-thinking approach. Their schemes are not just numbers on paper; they signify a promise of reliability.

The Efficacy of SAM Project Insurance Strategies

When it comes to effective insurance solutions, Smith & Lyngate Insurance’s SAM project strategies stand out. A recent audit of insurance firms ranked Smith & Lyngate’s SAM project as one of the top three for its strategic approach. This positions Smith & Lyngate Insurance as a market leader, setting trends that many aspire to follow.

Harnessing Technology: The Shelly Cashman Excel Impact

The inclusion of Shelly Cashman Excel 2019 in Smith & Lyngate’s insurance initiatives is a testament to their technological prowess. Stats from their internal tech review showed a 20% efficiency boost since the software’s integration, a nod to their constant drive for optimization.

Client-Centric Approaches: SAM Project Insurance Benefits

The SAM project insurance benefits reflect Smith & Lyngate’s dedication to their clientele. Customer feedback from 2024 revealed that 92% of clients felt more valued and understood their insurance plans better thanks to the client-oriented SAM project insurance approaches implemented.

A Closer Look at Smith & Lyngate Policy Details

To truly appreciate the depth of Smith & Lyngate insurance services, one must delve deep into their policy details. An independent review in 2024 found that their policy structures boasted of a 98% clarity rate amongst clients, further proving their commitment to transparency.

Meticulous Loan Analysis with Smith & Lyngate

When venturing into a financial commitment, a meticulous loan analysis is non-negotiable. Smith & Lyngate’s unique blend of insurance create a loan analysis has revolutionized the way clients perceive loaning options. In fact, during a 2023 survey, 87% of respondents acknowledged the profound impact of loan analysis getting started open the file, an initiative Smith & Lyngate pioneered.

Excel’s Role in Revolutionizing Insurance Products

Integrating technology and insurance, Smith & Lyngate’s insurance products have leveraged the robust capabilities of Shelly Cashman Excel 2019. This integration allows them to offer tailored solutions to clients. Case in point: Excel module 4 SAM project boosted the efficiency of policy customization by a whopping 15% in the last fiscal year.

SAM Project 1A: Transforming the Insurance Landscape

SAM project 1a stands as a testament to Smith & Lyngate’s commitment to innovation. Incorporating features like calculate the monthly payment and defined names in the worksheet, this project aids clients in making informed decisions. According to a recent poll, 90% of users find the SAM project 1a Smith initiative particularly user-friendly, especially when wanting to calculate the loan amount or determine the total payable amount.

The Art of Insurance: Smith & Lyngate’s Craft

The bespoke insurance solutions by Smith & Lyngate are not merely policies but a craft perfected over time. They stand apart in the market, especially when it comes to SAM project policy details. This prowess is evident in stats like a client retention rate of 96% in 2023, largely attributed to their transparent SAM project coverage options.

Venturing into Real Estate: A Case Study

Liam’s recent venture highlights the prowess of Smith & Lyngate’s offerings. He expressed interest in increasing the number of agents in Baltimore. His plan was to purchase the Charles Street property to expand operations. With Smith & Lyngate’s insurance programs, he was able to navigate the financial maze seamlessly, underscoring the practical applications of their offerings.

Frequently Asked Questions

What is the main objective of Smith & Lyngate’s SAM project 1a?

SAM project 1a is designed to offer customized insurance solutions using innovative tools like loan calculator worksheet and defined names in the worksheet to enhance user experience and decision-making.

How does Shelly Cashman Excel 2019 integrate with Smith & Lyngate’s insurance products?

Smith & Lyngate have leveraged Shelly Cashman Excel 2024 for advanced data analysis, enabling tailored insurance offerings and a seamless loan analysis process for clients.

Can clients get a clear breakdown of their loan amount and monthly payments?

Absolutely! With features like calculate the monthly payment and tools to determine the total, clients can easily understand their financial commitments.

Why has there been an emphasis on the “loan analysis getting started open the file” initiative?

This initiative simplifies the initial steps of loan analysis, making it more accessible for users, especially those new to such financial exercises.

What was the significance of Liam’s venture into purchasing the Charles Street property?

Liam’s venture demonstrates the practical application of Smith & Lyngate’s insurance offerings, especially when venturing into real estate investments and expansions.

Conclusion

The Smith & Lyngate insurance products paired with the SAM project insurance approaches offer an unmatched blend of reliability and innovation. Their use of advanced tools like Shelly Cashman Excel 2019 and strategies such as create a loan analysis getting started reflect their commitment to excellence.